Business

STA, 23 November 2018 - Mercator, Slovenia's largest retailer, posted a group net profit of EUR 9m for the first nine months of 2018, which compares to a EUR 10.5m loss in the same period last year, as sales rose by 1.6% to EUR 1.62bn.

Profit before income tax, depreciation and amortisation (EBITDA) rose by a quarter to EUR 87m, with operating profit (EBIT) surging by 157% to EUR 36m, the company said in an interim financial report released on Friday.

The improvement was driven by retail sales, which rose by 5.4% to EUR 1.2bn. "A new strategy, new store concept, store refurbishments and improved competitiveness of services are driving positive results in the core business," the company said.

On its key Slovenian market, retail sales improved by 0.5% despite what the company said was a significant reduction in store surfaces.

By the end of September, the group reduced its net financial debt by a tenth to EUR 738m, with the debt-to-EBITDA ratio going from 16 to 7.2.

Investments in fixed assets were almost halved to EUR 19m.

The number of employees dropped by more than 2% at group level to 20,322.

The core company saw sales improve by less than a percent to EUR 880m, while net profit remained flat at EUR 14.7m.

The financials do not yet account for the monetisation of real estate agreed in October, when Mercator concluded a sale and leaseback agreement with Austrian developer Supernova involving ten malls and worth EUR 117m.

Related: How to get a Mercator Pika card

STA, 20 November 2018 - Small and medium-sized enterprises in Slovenia generate 65.1% of added value and 73.4% of jobs in the non-financial sector of the economy, which is above the EU average, according to the annual report from the European Commission. The annual productivity of these companies was however almost 25% below the EU average.

According to the 2017/2018 annual report on European SMEs, Slovenian SMEs in the non-financials sector recorded a steep growth between 2013 and 2017.

Their added value was up by 33.4%, and number of employees by 5.6%, which is well above the performance of large companies in this department.

In the 2016-2017 period, added value generated by SMEs was up by 8.8%, which was the largest annual increase since 2008. Employment in the same period was up by 2.9%, which is also the largest increase since 2008.

Forecast remains positive for SMEs

The outlook for SMEs and the non-financial sector in Slovenia as a whole remains positive. Added value generated by SMEs is expected to increase by 11.6% in the 2017-2019 period, and employment by 0.6%.

According to the European Commission, the main challenge for Slovenia is still the shortage of qualified staff. It sees a solution in closer ties between the economy and the education system.

The Commission also thinks that Slovenia should find alternative sources of financing, especially for fast-growing companies which deal with innovation. It also calls for further reduction of administrative barriers.

The report, published on Tuesday, coincides with the 2018 SME Assembly, which is taking place in Austria's Graz between Monday and Wednesday. The European Enterprise Promotion Awards will be conferred there this evening.

STA, 16 November 2018 - The Supreme Court has reversed a decision in favour of Swiss franc borrowers, as it ordered a retrial in a case in which the Higher Court sided with the borrower's claim that he had not been forewarned about possible appreciation of the currency. The case was reported by the Bank Association of Slovenia on Friday.

This is one of the cases related to the by the Swiss central bank in 2015 to stop defending the value of the franc against the euro, which led to a surge in the value of the franc against the euro.

The affected borrowers in Slovenia have been trying to reach a systemic solution, including through the Franc Association, which is lobbying for a special law. In the meantime, courts are processing individual cases.

The key issue: Should Banka Slovenije have foreseen Swiss franc appreciation?

The particular case had been rejected by the court of first instance, while the Higher Court changed the ruling by completely upholding the claim by the borrower and finding the contract null and void.

According to the newspaper Delo, the case involves the Austrian-owned bank Banka Sparkasse.

The Bank Association of Slovenia, which advocates the case-by-case basis, argued today that the Supreme Court said the consequence of the bank failing to forewarn the borrower could not be the basis for annulling the contract.

The court added that when assessing loan contracts in Swiss francs, courts should take into account that the Slovenian consumer legislation at the time did not precisely regulate the mechanism of informed consent.

The Supreme Court added that an absence of loan calculations in any case must not be a decisive factor, according to the Bank Association.

The court has also confirmed that the central bank, Banka Slovenije, had not been able to project in its publications that the Swiss franc will appreciate, which had happened in 2011 and 2015. It is not possible to make reliable and precise forecasts regarding the period and extent of the change of currency exchange rate, it added.

While the impact of certain factors is predictable to a certain extent to experts, no expert could have predicted a unilateral measure such as that by the Swiss central bank in 2015, which had a decisive impact on the Swiss franc exchange rate, the association also quoted the court as saying.

STA, 15 November 2018 - Samo and Iza Login, the founders of tech firm Outfit7, top the list of the 100 richest Slovenians, compiled by Manager magazine, for the fifth year in a row. Their assets are estimated at EUR 689m, while total assets of the top 100 have been estimate at EUR 5.7bn, a new record and 10% more than last year.

The Logins are the principal founders of the company best known for its globally successful app Talking Tom, which they sold to the Chinese United Luck Group for US$1bn in January 2016.

The couple has transferred the proceeds from the sale to a family non-profit charity organisation, which looks for solutions for global environmental problems, said the newspaper publisher Finance, which publishes Manager magazine.

Following the Logins is Sandi Češko, the owner of multichannel retailer Studio Moderna, with EUR 334m, and Marko Pistotnik, one of the former owners of Outfit7, with EUR 210m.

€24.2m gets you to the bottom of the Richest Slovenians list

Also in the top five are Joc Pečečnik, the owner of gaming products provider Interblock, with EUR 194m, and Tatjana and Albin Doberšek of the Germany-based Engineering Dobersek, with EUR 183m.

With total assets of the top 100 breaking a new record this year, the threshold for making it to the exclusive company was also up to EUR 24.2m from EUR 20.4m last year.

This year's list features five newcomers and five individuals or families who have returned to the top 100.

The highest-ranking newcomer is Izet Rastoder, the owner of the banana trading company, Rastoder, who ranks 40th with EUR 36.2m.

The property Manager takes into account in compiling the list is majority stakes in companies or co-ownership.

Since many Slovenian businessmen have sold their companies over the past few years, the share of the proceeds from the sales in the total property of 100 richest Slovenians has been increasing to reach around 25% this year, Finance explained.

STA, 14 November 2018 - NLB shares were listed on the Ljubljana and London stock exchanges on Wednesday, bringing the sale of 65% of Slovenia's leading bank via an initial public offering (IPO) to an end. By selling NLB, Slovenia has partly met its commitment to the European Commission to sell 75% minus one share in exchange for a bailout in late 2013.

As the state has retained a controlling 35% stake, US financial fund Brandes Investment Partners (7.6%) and the EBRD (6.3%) have emerged as the two largest private owners.

The state has sold almost 12 million shares or 59.1% of all shares of NLB at €51.50 per share to get almost €609m, but taking into account an over-allotment option the stake could increase to 65% (€669.5m).

The seller is making an additional 1.18 million NLB shares available pursuant to the over-allotment option. The shares will be kept on a separate fiduciary account and be made available 30 days after the listing to make deals to stabilise the price.

"We remain a Slovenian banking group," NLB chairman Blaž Brodnjak said at today's listing on the Ljubljana Stock Exchange (LJSE), which was accompanied by symbolic bell-ringing when trading opened in Ljubljana at 9:15 AM.

The bank's shares have also been listed in the form of financial instruments known as GDR on the London Stock Exchange. NLB has become the first Slovenian joint-stock company to be listed in London.

"The head and heart of NLB remain in Ljubljana," said Brodnjak, adding that a new era was beginning for the bank, as "we have been very limited in our operations for five years", referring to the restrictive measures set down by the Commission.

Under the commitment to the EU, Slovenia has to sell another 10% of NLB by the end of 2019. Until then, the bank will be subject to a set of measures the Commission has imposed to make sure NLB is not in a more favourable market position than its competitors.

Once all limitations are lifted, it will be a "great privilege and great responsibility" for the bank, Brodnjak assessed, labelling today's listing as "the most important day in the bank's history".

Until the end of 2019, the bank is banned from making acquisitions, having aggressive advertising campaigns and performing leasing services.

Moreover, since the stake sold this year will be less than 75% minus one share, the bank will also have to start procedures to sell NLB Vita, its insurance subsidiary.

Brodnjak however hopes that it will be possible to negotiate with the European Commission the elimination of the remaining limitations and requirements. He noted that European Commissioner for Competition Margrethe Vestager will pay a visit to Ljubljana soon.

He believes that under a majority private ownership, the bank will develop in the sense of corporate management and freedom of operation. The bank is in a very good shape and is a systemically important institution in another five countries.

The group is also present in Serbia, Montenegro, Bosnia-Herzegovina, Kosovo and Macedonia, and the bank will now be vying for the "title of a regional champion", for which it has potential as it is familiar with the history and culture of the region.

Finance Ministry State Secretary Metod Dragonja said that with the transaction, Slovenia had met the first, most important commitment to the European Commission.

"Slovenia has clearly shown that it respects the commitments given. The credibility that the state has gained by doing so will make a positive impact on the state's and bank's credit ratings," he added.

Lidija Glavina, the chairwoman of Slovenian Sovereign Holding (SSH), said that SSH would continue with the sale of the remaining shares by the end of 2019.

"Despite the very demanding situation on financial markets, internationally renowned financial investors have decided to buy," she said, adding that NLB nevertheless remained "an independent Slovenian financial institution".

SSH will be able to sell the remaining stake after a six-month moratorium. There will be no price range and procedures will be simplified. "We will be waiting to get the maximum out of it," Glavina announced.

LJSE chairman Aleš Ipavec added that it was "an important day for the Slovenian capital market", while he did not wish to comment on the price of the share.

"Some are not satisfied as it is allegedly too low. But the market will show soon how much the share is really worth," he added.

The listing ceremony was also attended by representatives of regulators, the financial sector and some companies, mostly those traded in the prime market.

Slightly more than €500,000 in turnover with the NLB shares has been generated so far, with the price standing around €55, which is €4.50 above the price fetched with the IPO.

NLB closed the day’s trading at €56.65, 5.15 above the IPO price.

STA, 13 November 2018 - The EU Court of Justice has ruled in favour of a Slovenian company that filed a complaint against Austria over the system of bonds set down in the country's law on the prevention of payment and social dumping. According to lawyer Rudi Vouk, this is a landmark ruling that will have a positive effect on Slovenian companies doing business in Austria.

Čepelnik, a company based in Prevalje near the Austrian border, challenged the law after its client in Austria paid around EUR 5,000 to authorities in Völkermarkt in the company's place as a deposit for alleged violations instead of paying the company's invoice.

The EU court concluded that the legislation of a member state which allows the recipient of services to suspend payments to the contractor or to pay a security to guarantee the payment of a potential fine in place of the contractor "goes beyond what is necessary for attaining the objectives of protecting workers, combating fraud, in particular social security fraud, and preventing abuse".

The ruling is in line with the opinion of EU Advocate General Nils Wahl, who issued an opinion on the case in May. He said that measures like this system of bonds are in violation of the European directive on services and definitely exceed the scope of what is needed to enable national authorities to enforce national labour legislation.

Rudi Vouk, an Austrian lawyer of Slovenian descent, told the STA that the ruling was significant for Slovenian companies doing business in Austria.

Before the ruling, companies were in constant danger of their clients having to pay bonds for them in the event of the slightest alleged infringement of law. Additionally, potential clients were also aware of the possibility and potentially avoided Slovenian contractors.

"This danger has now been eliminated because the European court concluded that [the system of bonds] is not proportionate with the goals. Austrian legislators will have to annul the relevant provisions," Vouk said.

He added that other provisions, including those about minimum fines for infringements, "which are absurd", remain in place.

They have also been challenged at the EU court and given the latest ruling, there are reasons for optimism that the court would decide in a similar manner, Vouk added.

Čepelnik is one of the 121 Slovenian companies that complained with the European Commission over high fines and enhanced control of foreign companies providing services in Austria.

Other stories on the relationship between Slovenia and Austria can be found here

STA, 12 November 2018 - Joško Knez, the director general of the Environment Agency (ARSO), stepped down on Monday, over an internal review of procedures for granting environmental permits for a controversial Ascent Resources gas extraction project in the far north-east of the country.

According to a report by the news portal Siol, Knez has resigned because irregularities were uncovered in the review ordered by the new Environment Minister Jure Leben last month.

Leben ordered the oversight of procedures for extracting gas in the Petišovci area by the UK's Ascent Resources and its Slovenian partner Geoenergo. The latter is owned by energy companies Petrol and Nafta Lendava, which are in majority ownership of the state.

According to a recent report by investment research firm Morningstar, Ascent Resources had received "repeated" private assurances from senior government officials, especially at the Environment Agency, that it would be getting the permit soon.

Apparently the review struck a nerve and the UK-based company launched an offensive against Slovenia, and Leben in particular.

At the end of October, Ascent Resources said it was mulling taking Slovenia to "EU courts" over the delay, while the minister has had to face an onslaught from shareholders and the management of the UK company.

Ascent Resources director and shareholder Colin Hutchinson tweeted that the company "invested EUR 50m in the project to date and will not walk away. The permitting system in the country is in need of urgent reform and foreign investors should be very wary of investing until this happens".

However, the Environment Ministry said today that "today's report corroborates that the minister's suspicions have been warranted", as the principles of independence and autonomy of ARSO were violated in the two procedures.

Moreover, the report says that "persons from abroad apparently do not find unacceptable and contentious putting pressure on Slovenian officials and are willing to repeat them".

The findings of the review will be forwarded to the relevant authorities, including "all the efforts to put pressure on the ministry during the review".

Just today, three non-parliamentary parties and several environmental NGOs urged Foreign Minister Miro Cerar to summon UK Ambassador Sophie Honey over lobbying for the UK company.

The Pirates, Solidarity, and the United Left and Workers' Labour Party (ZL-DSD) alliance, accuse Honey of lobbying and putting pressure on Slovenian authorities to secure the environmental permit for fracking in the Petišovci area.

Ascent Resources claims it would use hydraulic stimulation and not fracking to extract gas in Petišovci. This was corroborated by Geoenergo, which said that the method used in Slovenia would differ from fracking as used in the US significantly.

The procedure, "cannot and must not be equalised with the hydraulic treatment or fracturing of shale ... There are significant differences between the procedures in Slovenia and those in the US ... that basically stem from the difference in the geological profile of the rock".

But the environmental alliance is unconvinced. "We're witnessing a reality show where multinationals are treating us as natives from the most underdeveloped countries and heaping alternative truths on us in line with the worst case of fake news," environmental activist Gorazd Marinček told the press today.

STA, 9 November 2018 - Slovenia's largest bank, NLB, fetched EUR 51.50 per share in the initial public offering, the bottom of the offering price range. The state will initially sell 59.1% of the bank for just below EUR 609m, but taking into account an over-allotment option that stake could increase to 65%.

Based on the pricing, the market capitalisation of NLB will be approximately EUR 1.03bn at the start of trading on the Ljubljana Stock Exchange and the Main Market of the London Stock Exchange on 14 November, a release from the bank and Slovenian Sovereign Holding (SSH) said.

The book value of the share capital at the end of June was EUR 1.51bn and the final offering price represents 68% of the share's book value. The SSH set the IPO offering price at EUR 51.50 and EUR 66 per share. The offering price in the aborted IPO last year was set at EUR 55-71.

The release says that the seller is making an additional 1,18 million NLB shares available pursuant to the over-allotment option which, if exercised in full, would increase the offer size to EUR 669.5m, representing 65% of the share capital on admission.

A stabilisation mechanism, the option is said to have been made available on the demand of large international investors. Stabilisation managers Citigroup and WOOD & Company will retain a portion of the shares to close deals within 30 days from listing in order to stabilise the price.

The shares are to be floated on the Ljubljana and London stock markets on 14 November when the settlement of shares is to take place. Investors have time to pay for their shares by then.

According to the pricing notification issued on NLB's website, the biggest single institutional buyers of shares are US financial fund Brandes Investment Partners (7.6%) and the EBRD (6.3%).

Since information on the buyers of shares in London are not public, detailed data on the dispersed structure of foreign owners will not be available when details are to be presented on 14 November.

Unofficially, the demand considerably outstripped what SSH was willing to accept in a bid to avoid the most predatory investors while forming a buffer if anything was to go wrong.

"We are very proud of having completed the offering of NLB's shares. Today's announcement represents a significant milestone in the privatisation process and in fulfilling our commitments to the European Commission," SSH chairman Lidia Glavina was quoted as saying in the release.

NLB chairman Blaž Brodnjak hailed the pricing as "another important milestone in the process of privatization". "We are looking forward to opportunities and challenges that the listing on the stock exchange will bring to the bank."

The government committed to sell the bank in exchange for the European Commission's approving a EUR 1.56bn state aid for the bank in late 2013.

While the state is to keep a controlling stake of 25% plus one share, it committed to sell at least 50% this year and any outstanding share of up to 75% minus one share by the end of next year.

Until the sale commitment is met in full, the bank will need to implement at least part of compensatory measures, including closing down offices in Slovenia, with 14 slated for closure in early December.

Moreover, since the state sold this year will be less than 75% minus one share, the bank will also have to start procedures to sell NLB Vita, its insurance subsidiary.

In addition, NLB will be able to approve new loans only if receives the minimum yield from equity instruments. NLB cannot do leasing business or make acquisitions either.

The bulk of shares in the IPO was offered to institutional investors. Retail investors were able to subscribe at least 10 shares at EUR 66 apiece. Unofficially they paid in some EUR 30m. The overpaid amount will be returned by 15 November.

The shares were also bought by members of the NLB supervisory and management boards. NLB chairman Blaž Brodnjak acquired 1,136 shares and the head of the supervisory board Primož Karpe 606 shares.

NLB paid out a total of EUR 378.2m in dividends to the state in the past three years. The state aid in 2013 amounted to EUR 1.56bn.

STA, 7 November 2018 - Employers were quick to condemn the planned overhaul of the minimum wage law, especially the way it is to be pushed through parliament. The Employers' Association stressed that any changes to minimum wage should be harmonised with social partners at the country's main industrial relations forum, the Economic and Social Council.

The Left presented on Wednesday a proposal to overhaul the way minimum wage is determined. The opposition party that acts as a partner to the minority government proposes raising the minimum wage to EUR 667 next year and to EUR 700 in 2020, before a new formula to calculate the wage is introduced in 2021.

Related: Proposal to raise Slovenia’s minimum wage from €638.42 net to €700 by 2020

The Employers' Association is unhappy with the way the bill was presented, "bypassing any dialogue with social partners". According to a press release, employers have experience with this practice, which has had serious consequences for companies.

Determining the minimum wage must be a matter of discussions and harmonisations among social partners, but the new bill has not even been presented to the Economic and Social Council, the association said.

Even stronger reaction came from the Chamber of Commerce and Industry (GZS), the country's biggest trade association, which called the proposal dangerous and expressed "shock" that the coalition should have backed it.

"It's trampling international agreements on social dialogue, something that government officials committed to at the first session of the Economic and Social Council over a week ago."

The GZS noted that only over a week ago it had "received a clear assurance from the prime minister that any change to the minimum wage would be agreed with the social partners".

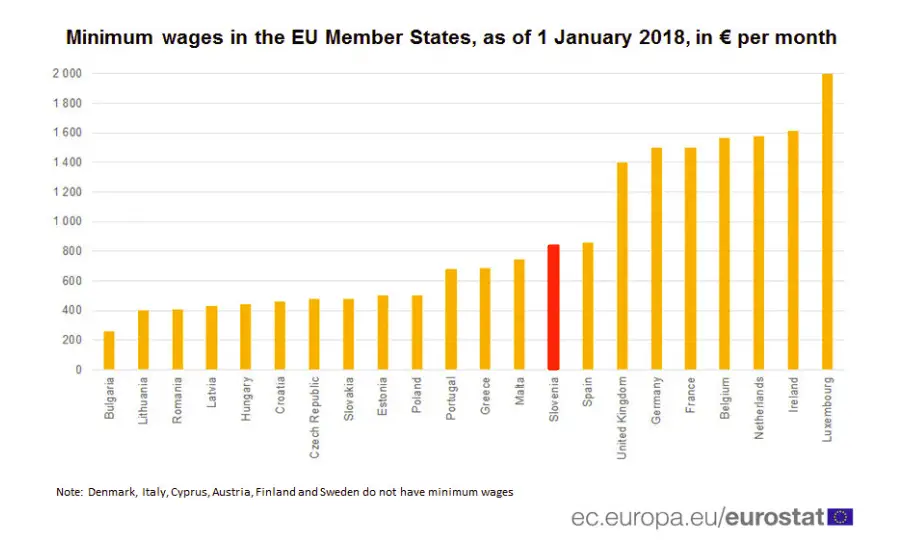

The figures in the chart show the gross minimum wage. Data: Eurostat

The Left's leader Luka Mesec said today that the party had agreed with Prime Minister Marjan Šarec for the bill to be discussed at the Economic and Social Council.

Nevertheless, employers are unhappy: "It is the middle of November, and companies and employers still do not know what kind of arrangement awaits them next year," the Employers' Association said.

The GZS said that most large companies would not feel the planned rise in the minimum wage, but that the increase would hurt companies where value added per employee was below EUR 20,000 and which employed 70,000 people.

The chamber argued that politics was interfering with the minimum wage all the time even though the share of those receiving it had been falling steadily and that even though the minimum wage in Slovenia was one of the highest in the EU.

"Each rise in the minimum wage generates more employees who earn minimum wage because it includes all those who had been in higher bracket until then," GZS said.

According to its data, average gross pay in the country has increased by 11% since 2010, while the minimum wage has risen by 41%.

The Chamber of Trade Crafts and Small Business (OZS) meanwhile said that it strives not only for raising the minimum wage but also for workers to have decent wages.

However, the state should cut labour costs to enable the workers to get higher net wages. "The difference between the gross and the net pay is too big. The state will get the most from raising wages," OZS head Branko Meh was quoted in a press release.

STA, 7 November 2018 - The Slovenian competition watchdog has pinpointed several potential issues with the proposed takeover of Slovenia's biggest commercial broadcaster by cable operator United Group as it issued a statement of objections on Wednesday as part of its regulatory review of the takeover.

The takeover of Pro Plus, which operates several commercial TV channels, could lead to horizontal concentration on the TV advertising market, the market for TV sports rights, and the wholesale of children's TV programmes, the Competition Protection Agency (AVK) said.

It also raises the prospect of permanent concerted action with other operators on the market and the possibility of licenses for the distribution of Pro Plus channels increasing. Competitive programmes in the bundles of United Group's Slovenian cable operator Telemach could be sidelined as well.

Finally, the acquisition could have other effects since "the combined company would acquire sensitive business information about their competitors, would give it a significant competitive edge," the document reads.

These preliminary findings do not prejudge the agency's final decision and United Group has 45 days to submit remarks in its favour.

As the agency points out, it may also propose "corrective measures eliminating serious suspicion about the conformity of the concentration with competition rules."

United Group said today that it was already drawing up its remarks. "We do however expect that the final decision will be in conformity with EU competition law."

Former AVK director Andrej Krašek commented on the statement for the STA, saying that such statements were usually issued when the watchdog intended to reject a takeover.

Krašek believes that, considering the facts presented to far, the AVK will reject the takeover, and it could be convinced to do the opposite only by large structural measures.

"The agency has examined the actual state and collected evidence, and the procedure is nearing its end. The acquirer has 45 days to state new facts to prove that the concentration is in live with the law."

But Krašek believes that, as the procedure has started a year and a half, United Group probably does not have much new evidence.

The biggest media takeover in Slovenian history is being closely watched.

Domestic media players and media experts have expressed fears that it may lead to excessive concentration of power in the hands of a single, US-owned media group.

United Group, meanwhile, has been berating the regulator for the long duration of the procedure.

Pro Plus not only owns two of the most popular TV channels, POP TV and Kanal A, it also operates several cable-only channels, a pay-per-view service, and 24ur.com, one of the top news portals in the country.

United Group acquired the media portfolio of the Central European Media Enterprises (CME) in Slovenia and Croatia, which includes Slovenia's Pro Plus, last July. The entire deal has been estimated at EUR 230m.

United Group is owned by the Kohlberg Kravis Roberts (KKR) investment fund and the European Bank for Reconstruction and Development (EBRD), but an agreement was reached last month to sell a majority stake to the international investment firm BC Partners.

STA, 6 November - Slovenia's major strategic asset in relation to China is its geo-strategic position or access to a 500-million European marker, Zdravko Počivalšek, the minister of economic development and technology, said during a visit to China, where he is presenting Slovenia's business and investment environment.

"Slovenia lies at the heart of Europe, which gives us access to a 500-million market," Počivalšek said as he visited the Slovenian Consulate in Shanghai Tuesday.

Pointing to a well-developed infrastructure, Počivalšek was quoted by his ministry as saying that to unlock the potential presented by the geo-strategic location, some improvements would be needed.

The minister, who is China for the China International Import Expo fair, praised the good political relations between Slovenia and China, the country's biggest trade partner outside Europe.

He stressed that as part of the 16+1 initiative, which brings together Central and East European countries plus China, the two countries had managed to boost economic cooperation to top 1.2 billion euro.

See all our stories about Slovenia and China here

"Over the past few years, we've managed to attract a number of well-known investors to Slovenia, which proves we have a truly encouraging business environment.

"I believe investing in Slovenia can also be an important opportunity for Chinese companies, particularly in infrastructure and tourism, which I've presented to my Chinese counterparts," said Počivalšek, who met several ministers in charge of the economy, including Chinese Commerce Minister Zhong Shan and his deputy Fu Ziying.

Počivalšek also met on Sunday his counterpart from the United Arab Emirates, Sultan bin Saeed Al Mansoori, to discuss Slovenia's participation in Expo 2020 in Dubai, and Austrian Minister for Digital and Economic Affairs Margarete Schramböck.

Meanwhile, State Secretary Aleš Cantarutti attended Monday's promotion of Chinese-owned Slovenian home appliances maker Gorenje's premium products in Beijing. The ministry believes this proves that Slovenian companies have a major impact in China.

The aim of the Slovenian delegation visiting China during the fair, which features 3,000 companies from 130 countries, is to strengthen economic relations with China, including in tourism, and intensify Slovenia's role within the Silk Road initiative.

Learn more about the Silk Road, Slovenia and China here